Railweb Reports

Is this rail’s decade on the Silk Road?

Posted by George Raymond on January 10, 2020

Rail freight between China and Europe is generally faster than sea freight and cheaper than air. Rail attracts high-value goods that can’t wait for a ship but can’t afford to fly – or no longer want to. In recent years, Chinese subsidies, better infrastructure and faster trips have fostered rail services on what is now called the New Silk Road. And climate awareness is growing by the month. Traffic on these services is booming. The “New” in Silk Road is starting to disappear. A late November 2019 conference in the Dutch city of Venlo focused on Silk Road growth, restrictions and tensions – and its potential in the new decade.

Eastbound containers and westbound conventional wagons meet on the Silk Road’s Middle Corridor in the south throat of Tbilisi central station in Georgia on 6 July 2019. Photo © Pierre-Noël Rietsch

Speakers examined why shippers are adopting rail as a third option within Asia-Europe-Asia supply chains still dominated by air and sea freight. They looked at Silk Road sustainability given the phaseout of subsidies, potential growth, climate benefits and a possible investment bubble in Silk Road terminals. Differences of outlook and political tensions between China and Europe coexist with the efforts of both the EU Commission and proactive EU members like the Netherlands to seek synergies with China.

Silk Road services connect the ex-Soviet rail network, whose rails are 1520 mm apart, with the 1435-mm rail networks serving China and most of the EU. The 1520 mm network extends beyond Russia into ambitious countries in central Asia and the EU’s Baltic states. To shorten trips, logistic operators have been seeking faster transloading at gauge-break points. Gauge-variable trains may be on the horizon. To better serve some regions, avoid restrictions and reduce risks, operators are also seeking new routes that may or may not involve Russia.

A major challenge is Europe, the Silk Road’s slowest and costliest segment. The Silk Road’s high-value freight may spur capacity improvements in EU rail lines and terminals. Europe’s freight trains are slowly getting longer. The Silk Road also faces changing restrictions like the Russian ban on foodstuff transit, the Chinese ban on railing dangerous goods, and the need to bring some products to a specific Chinese city for customs. Chinese railway wagons could better accommodate Europe’s 45-foot containers. Another key is digitalisation, including better tracking, information integration and arrival-time forecasts. And next to air and sea, a third competitor to Silk Road rail services is emerging: door-to-door trucking. But the tone of the conference was optimistic.

Contents

Modal choice in supply chains

Machiel Bode of the bank ING in Amsterdam said that until now, choice of transport mode has not really been a topic of discussion for many shippers. But as a compromise between sea and air freight, Silk Road rail services are making shippers reconsider supply chains.

Speed, cost and CO2 – in that order

Shippers think of speed first, then cost, and finally CO2, Mr Bode said. Ships’ slow steaming may get even slower. Silk Road rail services are four to six times cheaper than air. CO2 emissions for ship and rail are comparable. Mr Bode said that the decisive factors for performance of shipping options between China and Europe are pre- and on-carriage, tracking capacities and temperature control for sensitive goods. Silk Road rail is especially interesting for the deep hinterland, far from ports. If a container contains $40,000 of goods, sea freight is clearly better but for $600,000 rail is clearly better if you include capital costs. The total annual value of goods moving between Europe and China is currently €117 billion eastbound, €345 billion westbound. Given the value and required transit time of freight that now flies, Mr Bode said, 50% is eligible for Silk Road rail services.

Start of the Silk Road conference in the Dutch city of Venlo on 26 November 2019. Photo © George Raymond

Jan Rainer Strassburg of DB Schenker Eurasia pointed out that another criterion for mode choice is time to market. [GR: An example is fashion items that must be available during marketing campaigns.]

Mr Bode of ING said the biggest problems facing the Silk Road are the Chinese subsidies, bottlenecks, and the west European rail network. Its biggest opportunities are export potential from the EU, efficiency improvements and the development of intelligent multimodal routings for specific products and destinations.

Ton van den Hanenberg of Rotterdam University made a half-year study of the logistics, trade and politics of China’s Belt and Road Initiative (BRI), which has been a major force pushing Silk Road rail services. Looking at Dutch exports, he said that such services are appropriate for a container of lily bulbs worth €300,000 or more, but not for potted plants worth €40,000.

Alexander Labinsky of the Swiss forecasting firm Prognos said that cheap commodities will continue to move by sea. Thomas Kowitzki of DHL Forwarding said that ocean shipping lines are starting to have their own rail departments. [GR: This presumably allows them to leverage their established customer base.]

…but green is getting quite real

Stefano Pillot said that his company, Electrolux, has supplied appliances to 60 million homes in 150 countries. Their interest in Silk Road rail services as part of larger push for the sustainability sought by their customers and the larger population. Electrolux seeks better environmental performance in both production and use of its products in terms of energy use and renewabilty, water consumption and logistics emissions. It aims to help meet the Paris climate agreement.

Erik Groot Wassink of logistics operator Nunner said that companies are increasingly looking for green solutions within the EU and to and from China. He said that the train is eco-friendly, that its reliability is growing and that ever more terminals are being built in China and the EU – and not just in Germany. Roland Hawranek of Beijing Trans Eurasia International Logistics (BTE) warned that carbon taxes are coming.

An audience member said that water transport is greener than rail. Maja Bakran Marcich of the EU commission replied that this depends on both the direct CO2 emissions of ships and trains, but also how you produce electricity for locomotives and build facilities.

Chinese subsidies and market development

Joost van den Akker, economic affairs minister of the Dutch province of Limburg, said the Silk Road links 30% of the world economy. Venlo mayor Antoin Scholten called Silk Road a good name because it conveys value. But until now, Chinese subsidies have been boosting the development of Silk Road rail services. The conference examined how the disappearance of these subsidies and market forces will change the Silk Road.

Rapid growth

According to a Roland Berger study cited by railfreight.com, Silk Road rail traffic grew from 142,000 TEUs in 2016 to 274,000 in 2017 and 370,000 in 2018. DHL’s Thomas Kowitzki reported an explosion of Silk Road rail volumes in 2019. Clients are now discovering it. More trains are running, and lead times have dropped. Cost, lead time and low CO2 emissions are making rail attractive over ocean and air.

End of subsidy for empty containers

Dariusz Stefański of PCC Intermodal said that at the start of Silk Road services, subsidies allowed 10 of the 40 containers in a train to go both ways empty between the EU and China. In the long term, he said, the market, not subsidies, will be decisive. Mr Kowitzki said that earlier subsidies for the transport of empty container built up volumes and reliability.

Dmitrij Hasenkampf of DB Cargo Eurasia said that hundreds of eastbound containers in 2018 were empty because they got subsidies. Mr Strassburg of DB Schenker Eurasia said China then reversed this policy at the start of 2019 and required that a subsidised train’s containers be full. This held up whole trains, which hurt transit-time reliability and thinned service until the 2019 pre-Christmas season. Now 95% of the containers on trains are full.

Subsidy phaseout and economic viability of China-EU trains

Mr van den Akker of the province of Limburg said that new EU-China connections must be economically viable, and not depend on subsidies that will disappear. Tufan Khalaji of logistics operatior Nunner reported uneven traffic growth among Chinese Silk Road platforms due to different subsidy policies and platform costs. But both subsidies and costs are dropping. Peter Pardoel of logistics operator Cabooter said that the phaseout of subsidies will re-shuffle the relative importance of China cities in Silk Road rail services, and that his company doesn’t want to build services that depend on subsidies.

Kateryna Negrieieva of Rail Transportation Service Broker (RTSB) said her company runs 20% of Silk Road (or “BRI”) trains. Their main clients are companies linked to specific terminals (also known as platforms) who use RTSB trains over the 1520-mm network but have their own carrier from Małaszewicze to hubs in Europe. Working with United Transport and Logistics Company / Eurasian Rail Alliance (UTLC ERA), RTSB ran 3000 block trains in 2018 and expects to run 4000 trains in 2019 and 6000-7000 trains per year soon. Ms Negrieieva said that the Chinese government is now centralising the management of terminals, eliminating subsidies offered by cities and moving toward departures at fixed times.

Markus Bertram of logistic operator LTE said that the loss of Chinese subsidies will slow Silk Road rail volume growth. To compensate, processes must become more efficient. Otherwise the Silk Road will be just for high-value products, though it can be useful for much more. ING’s Machiel Bode said that the EU should try to benefit from the Silk Road flows that China has been encouraging with subsidies. At the least the largest Chinese platforms will survive without subsidies, he said.

Xavier Wanderpepen of Forwardis pointed out that mutualisation is not so strong in Chinese-Europe rail services as in air and sea. [GR: Consolidation of hubs will shift the focus away from trains directly connecting European and Chinese city pairs and towards hub-and-spoke systems, which can be more efficient for both full container loads and less-than-container-load (LCL) traffic.]

An audience member called predicting where China’s Silk Road hubs will emerge impossible. But some cities are more dependent on subsidies than others.

LCL shipments

Tufan Khalaji said his company, Nunner Logistics, was founded in 1955 in Austria. They are strong in eastern and western Europe and connect by rail to 15 main hubs in China. They have a big warehouse in Venlo and 575 employees. Mr Khalaji has been active in China since 2004, where he was the representative of the Dutch city of Arnhem in Wuhan and Wuchang. He started with Nunner in October 2019.

Mr Khalaji said that shippers like the “conveyor belt” nature of rail’s frequent Silk Road departures, which makes lead times less variable than on megaships.

Mr Khalaji saw lots of demand for less-than-container-load (LCL) shipments, which can need to go anywhere in EU to/from and anywhere in China. LCL volumes add up to substantial totals. They must be door-or-door. LCL shipments on the Silk Road require implementation of a hub-and-spoke system.

But Chinese interests have been resisting new connections that disrupt existing solutions, Mr Khaliaji said. Each Chinese platform seeks direct, point-to-point trains to European hubs and shuns cooperation with other Chinese platforms. LCL operators need to find cities willing subsidise movements on a spoke to a Chinese hub instead of directly to the EU. Every Chinese city now wants to go to Duisburg since Xi Jinping’s visit. So operators need to connect Duisburg by rail to other points in Europe.

In its new hub-and-spoke system, Mr Khalaji said, Nunner consolidates 10 containers of LCL for Europe a day in Xi’an. Xi’an’s role will increase because most trains pass there. He said that Xi’an is a better location than Wuhan and that Xi’an is cooperating better. From their offices in Duisburg, Warsaw, Hamburg, Helmond and Budapest, Nunner forwards LCL to anywhere in Europe.

LCL transit times are 20-22 days door-to-door and are strongly competitive to air, especially given a change in the postal law that will increase tariffs on air shipments in 2021. LCL will help assure sustainable volumes on Silk Road rail services despite the loss of subsidies.

Developing the EU for the Silk Road

Mr Strassburg of DB Schenker Eurasia said that the biggest challenges for Silk Road rail services are in Europe. Trains move 1000 km/day on the Russia network, he said, but only 300 km/day at twice the cost in the EU. Russia, Kazakhstan and Azerbaijan are also now investing heavily in the Silk Road, not just China. The EU needs to match this effort. “It’s not a question about Chinese subsidies,” Mr Strassburg said, “it’s about us”.

The east end of Małaszewicze Południowe station, on the Silk Road’s current main route, on 2 July 2019. We are looking southwest. Trakcja is renewing the 1435-mm tracks and signalling here. Photo © Trakcja Group

Thomas Kowitzki said DHL Forwarding was one of the founders of Hupac in 1967. [GR: Hupac co-founder Danzas later merged into DHL.] In 2008, as requested by DHL’s air and ocean clients, DHL started operating rail services to/from China, on which 100 DHL people in China and EU now work exclusively. Mr Kowitzki said that the Chinese are thinking about 2040 and 2050. Chinese Railways just opened their first European office in Duisburg. They can’t understand why the EU takes so long to build railway lines and terminals.

Mr Kowitzki said that the rising number of final European destinations [and origins] for Silk Road shipments means longer road or rail intra-EU trips. PCC’s Dariusz Stefański said that in China, “last mile” truck hauls of 1000 to 2000 km are common. The Chinese tend to think this should be acceptable in the EU too. The availability of Chinese subsidies for Silk Road rail services to Hamburg can mean that containers then must be trucked back to Warsaw. The Chinese find this normal. Mr Pardoel said Cabooter was seeking to become a champion of hinterland connections in Europe.

Roland Verbraak of logistics operator GVT said that China wants to continue into Europe with rail to a shipment’s final destination. He complained, however, that the average rail speed in Poland is 23 km/h.

Dmitrij Hasenkampf said that DB Cargo Eurasia has a subsidiary in Russia and an office in China. As a third option (after air and ocean) to connect their EU and China distribution networks, it is starting to connect rail networks in China and EU. He said that DB Cargo Eurasia benefits from DB Cargo’s EU network. Mr Hasenkampf saw a need to build rail distribution within Europe of Silk Road services to maintain volumes and frequencies. Three departures per week make a Silk Road service reliable, he said.

State-imposed restrictions

The conference addressed state-imposed restrictions that include customs problems, Russian and EU bans on certain products, and China’s ban on railing dangerous goods.

Customs clearance

LTE’s Markus Bertram complained that at border points, custom officials sometimes don’t know what rules apply, and suddenly crack down on cases that were previously okay. Also, a customs bond can’t be transferred to a westbound train arriving in Małaszewicze until the previous one has arrived in Tilburg. Volker Schliesche of SGS Germany said that they have a financial solution for this problem.

GVT’s Roland Verbraak said that only one China city is specialised for each agro-food product type, including meat. An audience member said that you can’t send meat or milk powder to every Chinese city – only one city may have an import licence for a category of goods.

Oscar Vermeij of New Silk Way Logistics (NSWL) said that one consignment note to accompany shipments is now recognised under both the European legal regime (CIM) and that of the CIS and China (SMGS). Mr Verbraak of GVT said that the goal is a “customs freeway”. Customs systems are being integrated, but the Chinese characters are a problem.

Nunner’s Tufan Khalaji said that from 2021, air shipments will be subject to customs at a lower shipment weight. Customs clearance for LCL shipments moving in Silk Road rail services is not different from air shipments. A problem with one LCL shipment can hold up all the shipments in that container. But this is true in all modes.

Russian sanctions on the EU

Sebastiaan Bennink, a lawyer at Wladimiroff Advocaten in The Hague, called the Russian sanctions regime complex. Although Russia lifted its transit ban on EU agricultural products and foodstuffs in July 2019, Mr Bennink said, such goods crossing Russia must bear an electronic seal and tracking device of the RT-Invest Transport System. Its owners are Rostec and Igor Rotenberg, both of which are subject to US sanctions with which EU financial institutions comply.

RTSB’s Kateryna Negrieieva said that Russia has yet to name the supplier of the navigation system for seal tracking. Hanno Reeser of Essers and New Silk Way Logistics (NSWL) said that the details will become clear within the next three to four months and that the removal of sanctions in Russia transit will double eastbound traffic. Mr Khalaji of Nunner said that the lifting of Russian sanctions on agricultural products such as Dutch flower bulbs will shift them from ship to rail.

EU sanctions on Russia

The Russian sanctions had been a response to those that the EU imposed on Russia during the conflict in Ukraine.

Mr Bennink, an expert on export controls, said that the sanctions on Russia remain in force and that violations can result in criminal prosecution. Sanctions are politically driven, he said. They exist whether you think they are fair or not and you have to deal with them even if you are far away.

He cited the example of a Dutch company that exported “a little metal box” worth €500 to an Iranian University on the sanctions list. Dutch authorities prosecuted and fined the company and excluded it from public tenders.

Western sanctions allow the export of metal pipes and tubes to Russia for non-military uses. The destination of freight sometimes reveals its intended use. A seller must know the buyer’s business: Military? Agriculture? The EU may consider goods military if their final destination is Crimea, even if imported at St. Petersburg. Specialised websites show sanctioned goods, industries and purposes, geographical destinations and risks. The seller can cover itself by learning from the buyer exactly how, where and by whom goods will be used. A buyer that does not provide this information merits a red flag.

Mr Bennink said that a strong compliance system allows a seller to do business with partially sanctioned buyers because the seller can show that their transaction is legal. Both managers and people directly involved in an illegal transaction can be prosecuted. Keep your emails in case something goes wrong.

Dutch authorities also convicted a freight forwarder for not catching laser-guided bombs destined for Saudi Arabia. To learn the destination and purpose of goods, a forwarder must make a “reasonable effort” commensurate with a transaction’s value. For a €2 million shipment, you may need to go beyond websites and employ an investigator in the destination country.

Dangerous goods in China

In its introduction to a session on dangerous goods, the Venlo conference programme said that the transport of dangerous goods on Silk Road rail services has been impossible until now due to restrictions in China, but that this is about to change.

Mr Strassburg of DB Schenker Eurasia said that China is the only country that thinks dangerous goods are more dangerous on rail than on roads. [GR: Because China forbids dangerous goods from trains but not from trucks, some dangerous shipments now travel all the way to Europe by truck. See the section on trucking below.] GVT’s Roland Verbraak said that the Chinese authorities forbid rail carriage of batteries separately from their devices. Mr Hasenkampf of DB Cargo Eurasia saw great potential for Silk Road rail in the currently banned transport of batteries for electric cars.

A quest for shorter lead times and new routes

In their efforts to reduce Silk Road lead times, logistics operators are seeking more efficient border crossings. To better serve some regions, and avoid restrictions and risks, they are also looking for new routes. Mr Labinsky of Prognos pointed out that logistics companies always find workarounds to present and future sanctions and other constraints.

Mr Hasenkampf of DB Cargo Eurasia said that containers that travel between the EU and China may continue (full or empty) on other routes. He said that the market is going toward connecting customers instead of cities. Mr Bode of ING said that the map of EU-China rail connections are changing every month. His map showed three routes: all-Russia, via Kazakhstan and the Middle Corridor via Azerbaijan and Georgia.

Border crossings

Mr Pardoel of Cabooter said the gauge-break points [at the east and west ends of the 1520-mm network] have made great gains in transhipment speeds, but that improvements are still possible.

Markus Bertram of LTE said instead of building parking places for trains, border crossings should instead improve their processes. He said that at Frankfurt/Oder, at the Polish-German border, changing drivers on a multi-system locomotive requires only 10 minutes. Opening new border crossings is one solution, but processes need streamlining at all crossings. Mr Bertram said that business there is “like a full bathtub: you just have to find and pull the plug so it can flow”.

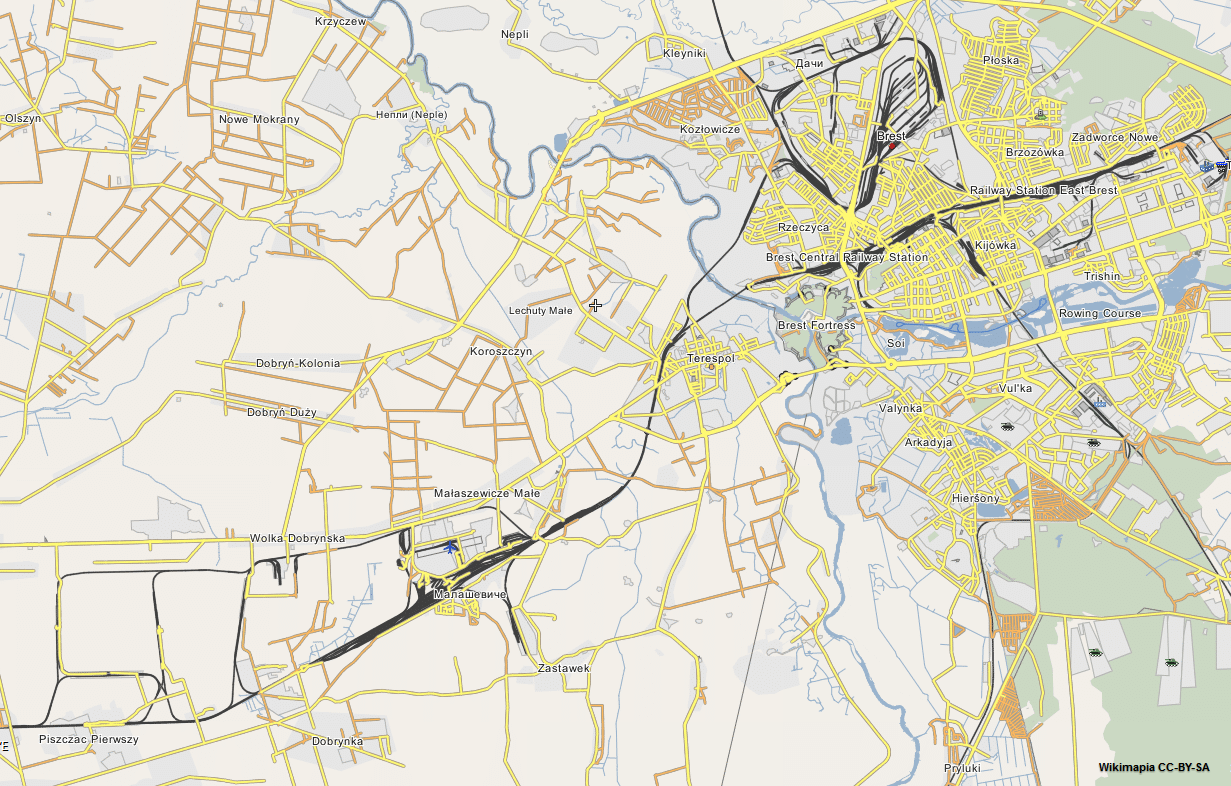

Brest and Małaszewicze

Hanno Reeser of Essers/NSWL said that in 2016, the rail complex at Małaszewicze, at the Polish-Belarus gauge break, was a bottleneck. Ever faster transloading now allows Silk Road transit times via Małaszewicze of 14 days from terminal to terminal. Involved actors are trying to reduce this to 12 days.

Rail facilities of Małaszewicze and Brest. From Ukraine, the river Bug flows north and west between Poland and Belarus. Its waters reach the sea at Gdańsk. Source: Wikimapia; download 8 January 2020.

ING’s Machiel Bode said that lead times on the Silk Road are 15 to 25 days, but pure movement is only 10 days. The Xi’an-Duisburg transit time of 12-14 days is stable. The bottlenecks at Małaszewicze are gone.

Mr Bertram pointed out that Brest-Małaszewicze is not just a gauge break, but also a change of customs union. Małaszewicze, where westbound trains stop, has gone from one to five terminals within last three years. Mr Kowitzki of DHL noted a tremendous speed-up in Małaszewicze. Borders were stuffed, but fixes in Małaszewicze and the opening of Kaliningrad [see below] have now improved the situation. Eastbound trains go to Brest. Mr Hasenkampf of DB Cargo Eurasia reported congestion for eastbound traffic in Brest and some delays in peak seasons in Małaszewicze due to construction work.

Kaliningrad

Roland Hawranek said that his Chinese-owned company BTE both operates block trains and organises the movement of single containers as a forwarder. They have five locations in China and four in the EU. They run 600 block trains per year. He said that the port of Kaliningrad in the Russian enclave of the same name has relieved Małaszewicze and that transit times have dropped.

LTE’s Markus Bertram said that Kaliningrad is now having the same growing pains that Małaszewicze had once had.

The Middle Corridor

Mr Pardoel of Cabooter called the port of Baku in Azerbaijan a key point on the Middle Corridor. Cabooter is developing trucking, warehousing and crossdocking there and progressively extending rail services eastward from Europe to Baku and beyond to China. He said that Rail Cargo Austria and Baku had signed an agreement on November 25. Cabooter is running test trains from Baku not just to Venlo, but also to Prague; the first train under the Bosporus at Istanbul was theirs. A new train will run from China via Istanbul to Venlo by the end of 2019, Mr Pardoel said.

Westbound container train on the Silk Road’s Middle Corridor about 3 km north of Tbilisi central station in Georgia on 6 July 2019. Photos © Pierre-Noël Rietsch

Mr Khalaji of Nunner said that Central Asia is also important to Nunner’s strategy. Mr Strassburg of DB Schenker Eurasia said that economies of scale will cut unit costs on the Middle Corridor by 50%.

Tural Aliyev of the Port of Baku said that a free trade zone under development at the port should become a major consolidation and distribution centre in central Eurasia. It will provide logistic services for the southern Caucasus, central Asia, Iran, southern Russia and Turkey.

Mr Aliyev said that the ancient Silk Road used the Middle Corridor and Azerbaijan, which is still at the intersection of north-south and east-west routes. Silk Road rail shipments now take 16-17 days to move from China to Istanbul and Ukraine. Embargoes in Russia and Iran help the Middle Corridor, which runs between them.

The Coordination Committee for the trans-Caspian Route was founded in 2014 and became an association in 2017, Mr Aliyev said. It includes 10 ports undergoing infrastructure upgrades. Its main routes westbound are all-rail via Istanbul or via the Black sea and Ukraine.

On the Middle Corridor, Mr Aliyev said, Baku wants to be the hub of the hubs. It handled 23,000 TEUs in 2018. Some 130 million people live within 1000 km. A main activity is petrochemical products. Industry and logistics are developing in nearby Alat township, the site of a new port that seeks synergies between rail and ship. The Alat Free Trade Zone wants to attract a variety of businesses, such as final assembly and localisation of goods for more-or-less-distant consumption zones. Mr Aliyev said that the Alat FTZ has no or low taxes and custom duties and easy visa procedures; arbitration is in London. According to the European Sea Port Organisation, Mr Aliyev said, Alat/Baku will be the first Green Port on the Caspian Sea.

Other new routes

Erik Regter of the Austrian Rail Cargo Group said that in recent years, RCG has developed rail shuttles to move containers arriving by ship in Piraeus, Greece, and the Adriatic ports to Budapest for assembly industries in central Europe. On what he called the continental Silk Road, RCG is developing the route via Ukraine and exploring possibilities via Turkey.

Cabooter’s Peter Pardoel said that each Silk Road routes has stronger and weaker points along it. Cabooter is developing a variety of routes – and running test trains on them. Running via Russia is plan A, but it’s good to have plans B and C. They are looking at bringing containers from China by ship to Trieste, Italy, or Pireus, Greece, where the Chinese are present, and from there by train to the Netherlands.

To diversify risk, clothing makers are moving some manufacturing from China to Turkey, Mr Pardoel said. Cabooter just started a Turkey-Budapest-Netherlands train. Single wagons have been moving among all these countries for decades, and this can be the basis for container trains.

Mr Khalaji of Nunner showed a map of Silk Road routes including what he called the “difficult” Silk Road southern corridor via Iran. A young man from Oman who is studying in the Netherlands asked about routes to the Middle East. Mr Pardoel said that in the future, Cabooter wants to connect Pakistan and India. Routes via Iran are possible but blocked by embargoes.

Flow imbalances

A major challenge for the Silk Road is the dominance of westbound traffic. Speakers looked at capturing eastbound traffic bound for China and other Asian countries, including household appliances, high-tech products and particularly agricultural and food products moving under temperature control. Seasonal traffic imbalances are also a challenge.

One of the conference’s panels on 27 November 2019. Mr Khalaji is on the left. Photo © George Raymond

One of the conference’s panels on 27 November 2019. Mr Khalaji is on the left. Photo © George Raymond

Filling eastbound trains

Ms Negrieieva of RTSB said that the Chinese middle class has been growing 4% a year since 2002 and now is 56% of the population. Many Chinese now travel and acquire a taste for EU products. She also mentioned problems with domestic Chinese food supplies. For example, pork diseases in China could increase prices by 40%, and China is thus looking for meat sources in the EU.

Stefano Pillot said that Electrolux has customers in China. GVT’s Roland Verbraak pointed to a “Holland House” in Venlo that shows all the products China could buy.

Mr Ribao of the Chinese Embassy said that “China is opening its door wider to Netherlands and the whole world”. The demands of the Chinese population for agricultural and high-tech products is increasing. China is deepening reforms, opening pilot trade-free zones, bringing down tariffs and reducing non-tariff barriers and the institutional costs of imports. Punitive laws for intellectual property violations are being enacted. Foreign investment restrictions are lifting. China will continue to remove restraints on economic development. “China is reaching out to the world”, Mr Ribao said. Europe should take advantage of the Silk Road to increase exports to China.

Mr Labinsky of the forcasting firm Prognos said that total Europe-China freight volume is forecast to increase by 50% between 2020 and 2035 in both directions, but eastbound will still be about half of westbound. Mr Strassburg of DB Schenker Eurasia said that ocean shipping lines are very good at balancing flows and at empty container management. Containers are built in China so that their first trip is in the dominant traffic direction. The traffic imbalance is worse in sea freight than in rail. [GR: This may be because Silk Road rail services can skim high-value eastbound freight from sea services.] Chris Wensink of the consulting and research firm Panteia said that trade visits are promoting “the Dutch case” for EU-China rail freight. Mr Khalaji of Nunner said that growth of eastbound Silk Road rail traffic will lower westbound rates.

Mr Reeser of Essers/NSWL said that the Silk Road could help European exporters reach consumers in Asia generally, not just China.

Reefers

Oscar Vermeij said that his company, New Silk Way Logistics (NSWL), was founded in 2016 by Essers and KLG. Essers has a large intermodal network; KLG has an LCL network in the EU and China. NSWL connects at Xi’an and Chongqing to Sinotrans, which coordinates Silk Road rail connections to Chinese terminals. Mr Vermeij said that the Venlo-Chongqing service is part of Lean and Green Offroad, a Dutch programme that stimulates joint corridor development. Limburg Region’s development and investment company (LIOF) is also involved.

Mr Vermeij said NSWL has a temperature-controlled supply chain on the Silk Road. It is poised to serve fresh-product traffic, which will boom when Russia allows such products to transit. Eastbound and westbound, his company’s reefer fleet reports location, fuel level and temperatures every 15 minutes to their control centre in Romania. The company has service points to refuel the reefers or fix problems. He said that food, pharmaceutical, chemical, hi-tech, automotive, clothing and agricultural products can need temperature-controlled containers. An audience member said that dairy products move by rail from Moscow to Russia’s Pacific coast in reefers that carry fish the other way.

The west end of Małaszewicze Południowe station on 2 July 2019. Trakcja is rebuilding 11 tracks and installing 15 turnouts. Google Maps shows that these tracks’ lengths range between about 730 and 830 metres. The station’s north tracks are done; the south ones are next. Photo © Trakcja Group

Mr Strassburg of DB Schenker Eurasia said reefers can refuel at the Polish and Chinese borders and then must run for only 5 days across the 1520-mm network. GVT’s Roland Verbraak said that fixing reefer problems on the 1520-mm network is difficult. Mr Strassburg asked what is better, expensive diesel equipment or standardised electric containers as on ships? An audience member said that reefers with axle generators might be greener. [GR: They could also be cheaper, especially since they would eliminate labour-intensive fueling. A power line from the locomotive would be even cheaper but require connector standardisation, as least within Silk Road wagon fleets.]

Salmon to cross Russia

Railway consultant Micael Blomster described a Salmon Silk Road for the rail movement of Norwegian salmon through Russia to China. The elimination of Russian sanctions on the transit of fresh fish opens new possibilities. Born in northern Sweden, Blomster lives in Helsinki. He said that a Nordic freight corridor starts in the port of Norvik in Norway, from where freight can reach the US, Halifax and Iceland. Norvik handles some 100,000 TEUs yearly. The corrider runs through Haparanda, Sweden, a gauge-break point from which 800-metre trains depart onto the 1520-mm network. From there, containers continue to Kouvola, Finland, and Kaluga, Russia. After a second gauge break at Khorghos, on the Kazakhstan-China border, containers continue to Chengdu or Xi’an.

Mr Blomster said that major Finnish imports are oil and Mercedes Benz automobiles. The latter can come by rail from China.

Breeders produce 1.3 million tonnes of salmon in Norway yearly, Mr Blomster said, of which 600,000 tonnes move via Norvik. Three trains carrying 6000-7000 tonnes of salmon depart every night, as do 400 trucks that bring the fish to Helsinki, departure point for 17-18 flights a day to Asia, where the salmon is fresh on the table in 36 hours. In the future, salmon could also move on Silk Road rail. Finland’s connections and relationship have remained good with Russia, which is talking about lifting the salmon ban. The yearly Chinese consumption of 240,000 tonnes of salmon corresponds to one train a day.

The 10,000-km trip from northern Norway to China is possible within 12-14 days, which would put the salmon on Chinese tables on 21-27 days. But how can it then still be fresh? The solution is a technology called BluWrap, which prevents spoilage with a special atmosphere in a sealed bag kept at -1° so it doesn’t spoil or freeze. Pork already moving this way arrives fresh in Australia after 90 days, Mr Blomster said.

Compared to air or ocean, the rail solution produces less CO2 and moves the salmon in boxes that return empty, are not wasted and are recyclable eventually as paper. Shipment costs are €1.5/kg by air and €0.27/kg by rail. Mr Blomster said the operation is now waiting for sanctions to lift. Currently, salmon for Russia is produced in Belarus.

Seasonality of volumes

Ms Negrieieva of RTSB reported a shortage of space in trains in October and November 2019. DHL’s Thomas Kowitzki said that the supply of reefers for Silk Road services is a problem in the pre-Christmas season peak.

Road transport between China and Europe

Now that China has adopted the standard international transit document for trucks, door-to-door trucking between China and Europe is poised to develop. Despite trucking’s pale green credentials, this mode may prove attractive to shippers of high-value, fragile shipments requiring a guaranteed day of arrival.

China adopts standard document for trucks

Viacheslav Vikentyev of the International Transport Union (IRU) said that the standard customs document for road transport known at the TIR carnet is now recognised on the entire Eurasian landmass. It serves as a transit declaration and guarantees payment of customs taxes. The TIR convention was born in 1949; China joined in 2016. First Chinese tests started in 2018 and regular operations in 2019. For truck movements between China and the EU, the main border point is Khorgus, where Kazakhstan has agreed not to check 99% of trucks from China. The TIR carnet guarantees up to €100,000 in EU and China and €60,000 in Russia and Belarus. But two TIR carnets double coverage. Some scope exists for using the TIR guarantee even if part of a shipment’s route is on rail.

Until 2017, non-Chinese trucks could access warehouses up to 50 km from the border. Now a truck from Russia can drive as far into China as required. (In principle, so can trucks from Belarus, Georgia and Turkey, but this is not yet operational.) Both China and the EU admit Russian trucks on their roads.

Truck transit time and cost

Mr Vikentyev said that door-to-door truck trips between China and Europe range between 7000 km in 11-13 days and 11,000 km in 18-19 days. A current example is frozen meat that moves by truck from China to Belarus. [GR: For the moment, EU food products still can’t cross Russia to reach China. See the section on sanctions on the EU.]

A China-EU truck never stops, Mr Vikentyev said. Drivers change every eight hours. A similar service first ran between the EU and Russia, for example to bring flowers from the Netherlands in five days. Trucking is typically 20-25% faster than sea or rail. Road transport can beat air if a shipment must wait for a flying slot, which can delay it for two weeks. Truckers can guarantee an exact day of delivery.

ING’s Machiel Bode said that truck transport’s door-to-door service makes it competitive with rail, air and ocean. He wants to add trucking to other modes in his comparisons.

Mr Vikentyev called the current cost of a truck from China to Europe high: about $12,000. In some cases, however, trucking can be cheaper than rail door-to-door, he said. The loss of rail subsidies will make trucking more attractive. Chinese operators, largely unaware of the new TIR regulations, have not entered the market yet but will do so within two to three years. As in Europe, Mr Vikentyev said, truck drivers are increasingly hard to find in Russia and China. The IRU is working on this.

Rien Gulden of DB Schenker said that trucking is closer to air than rail, but unlike air trucks go door-to-door. Trucking has specific security problems, however. Customers may be willing to pay for a truck to reduce time to market. Top origin countries for trucks bound via China to Europe are Japan, Vietnam and Thailand.

Shocks, vibrations and damage

Mr Vikentyev said that China-Europe truck transport is appropriate for fragile, high-value goods subject to damage during container transloading at gauge-break and other terminals in Silk Road rail services. Rien Gulden of DB Schenker said that shippers of fragile freight need to consider vibration and shocks. A container can suffer more shocks on ocean freight than on Silk Road rail services, and Russian roads can be bad.

Truck trailers by rail?

An audience member from RailTech Invest of Latvia asked whether truck trailers can travel between China and Europe on Silk Road rail services. GVT’s Roland Verbraak said that unlike the EU, Russia and China aren’t yet equipped to move truck trailers on trains.

Oversized and bulk cargo on the Silk Road

Logistics operators are looking for alternate ways of moving oversized and bulk cargo from China to Europe and back.

Oversized cargo

Nunner’s Erik Groot Wassink said that truck transport is good for oversized cargo, at least within China, even if the rest of the voyage from to/from EU by rail. Nunner’s Tufan Khalaji said that trucking costs are higher per kilometre in China than in the EU.

Mr Hawranek of BTE said that any container that can fit on a flat wagon can move on the Silk Road, but that Chinese subsidies are not available for open-top containers. [GR: Shippers pay a premier for ocean transport of containers on which other containers cannot be stacked. For shipments that do not fit on a railway flat wagon, truck transport is now an alternative to sea.]

Bulk shipments

Mr Strassburg of DB Schenker Eurasia said that within China, ore sometimes moves in open-top containers that carry general freight in the other direction. Mr Kowitzki of DHL said until now, bulk goods have not been worth moving on the Silk Road.

Longer-term strategies and development

Longer-term Silk Road strategies and developments include risks of an investment bubble and synergy between EU and Chinese strategies.

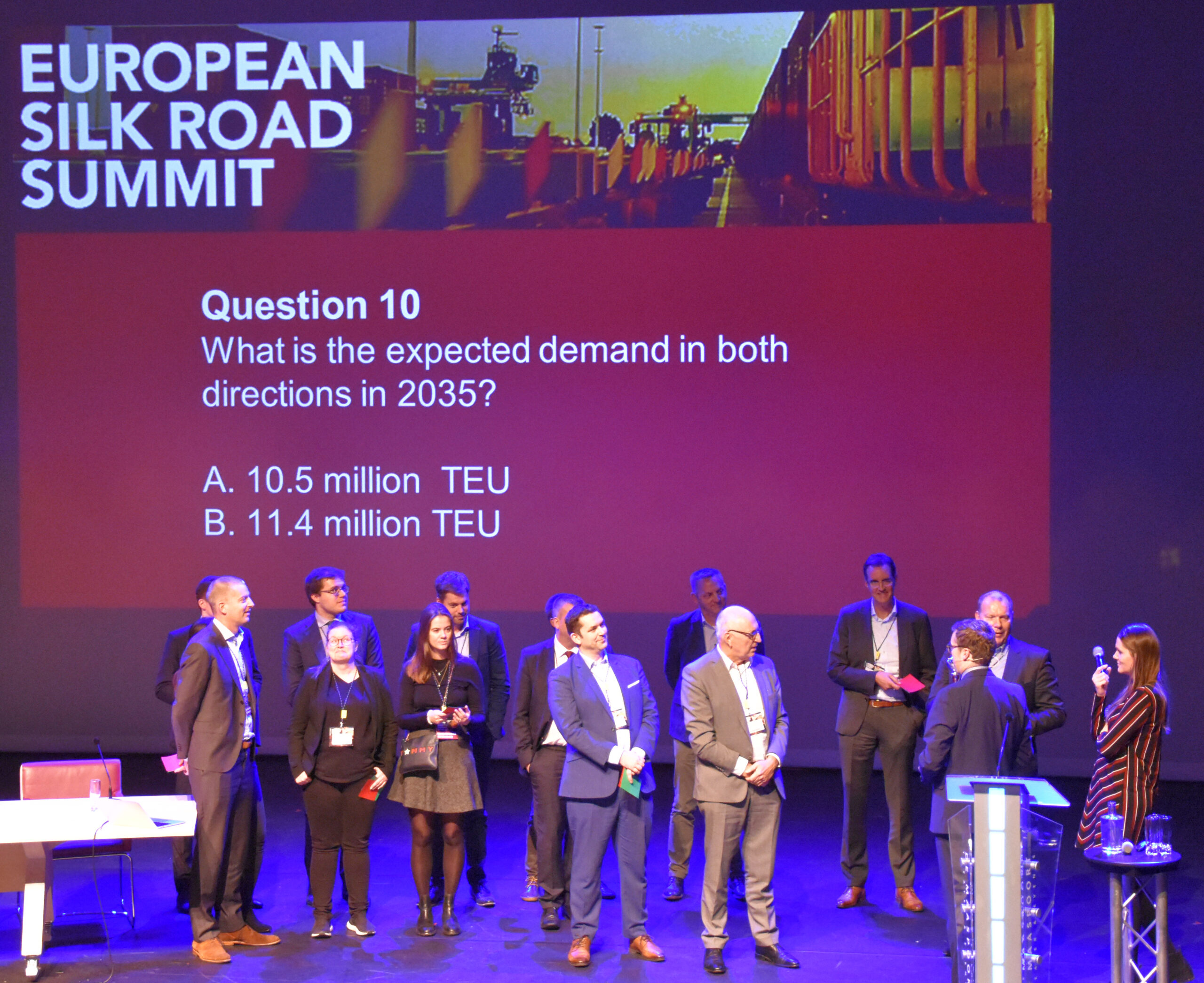

Market and capacity growth

Alexander Labinsky of Swiss forecasting company Prognos asked whether forecasted demand and proposed infrastructure capacities will align. The portal railfreight.com cited a Prognos projection of 8.2 million TEUs in 2020 and 11.4 million in 2035. Mr Labinsky said that quantitative forecasts on expected traffic flows along the Silk Road are scarce, geographically aggregated and mostly exclusively focused on rail traffic. He examined future traffic flows between China and Europe and compared them to existing and proposed infrastructure capacity. The question, he said, is whether the promises of China’s Belt and Road Initiative (BRI) will be fulfilled – or whether instead an investment bubble is developing. [GR: The ambitions of BRI underly Silk Road rail development largely but not exclusively.]

Conference attendees who knew all 10 answers of a quiz on 27 November 2019. Photo © George Raymond

Conference attendees who knew all 10 answers of a quiz on 27 November 2019. Photo © George Raymond

Capacity expansion plans for terminals along the Silk Road are easier to obtain than future volumes, Mr Labinsky said. Silk Road rail volume increased from zero in 2013 to 370,000 TEUs in 2018. Some 5% of TEUs moving between East Asia and Europe now do so on Silk Road rail services. Containers moving within Russia and between China and Russia also use Silk Road train capacity. The number of itineraries and players at border crossings is growing.

Mr Labinsky cautioned that while forecasts help you think about possibilities and potentials, they are not reliable numbers you can build on. Transhipment capacity is being tripled from 300,000 to 900,000 TEU at border crossings, but will these volumes appear at all the crossings? Capacity is being added faster than projected volume growth. However, Mr Labinsky sees much room and potential for growth on all the corridors. New traffic will come not just from ships, but from new economic activities. But what happens if volumes are not attainable? A ruinous price war could result. Or the Silk Road could settle into a niche role. Market players need to look at opportunities in Asia other than China – room for them is abundant.

Mr Labinsky also asked whether the EU rail network is ready for the extra volume. The Netherlands seems to be a good place for logistics, but this will be useless if the German railways are clogged. Thus far, he said, he has only studied transhipment capacity, not capacity of lines. And his studies do not yet take account of emerging hub-and-spoke systems.

Synergy between EU and Chinese strategies

Maja Bakran Marcich, deputy director-general of the EU Commission’s Directorate-General for Mobility and Transport (DG MOVE), said that connectivity of infrastructure is a priority and important foundation for EU-China cooperation and development. The EU Commission is seeking synergies between Europe’s TEN-T policy and China’s Belt and Road Initiative (BRI). She said that the objective is to promote sustainable development of infrastructure, openness, transparency and a level playing field in the area of infrastructure connectivity.

Since 2015, an EU-China connectivity platform has been seeking synergies to make the Trans-European Transport Network (TEN-T) meet the BRI to make them interoperable and compatible in an effective and sustainable way. Key aspects are reciprocity in market access, open program procurement, fair competition and respect of international standards. China’s powerful economic planning unit, the National Development and Reform Commission (NDRC) and DG MOVE are preparing for a Joint Study on Sustainable Railway-based Comprehensive Transport Corridors between Europe and China. They are looking together at sustainability (both environmental and financial) and transparency. DG MOVE wants wide stakeholder participation, including EU member states and associations.

Ms Bakran Marcich said that DG MOVE is sharing the EU’s vast TEN-T experience with their Chinese colleagues. The TEN-T network includes rail, ports and airports and seeks safety, security, fair public procurement and climate-friendly sustainability. A special focus is on cross-border links. The study will examine the current situation and future flows. Developments in Asia-Europe transport will lead to revision of the TEN-T.

Land links between Europe and Asia, particularly China, need better connectivity, Ms Bakran Marcich said. New rail services appear daily, but connectivity requires more trains and reduction of bottlenecks. New infrastructure should favour green modes and should benefit local populations and not put them in debt. Connectivity goes beyond transport, to include people-to-people, energy and digital links. A key element is the countries between the EU and China and hubs on the Caspian and Black Seas. The EU is planning financing to 2030 for construction of links to “Eastern Partnership” countries, including links, terminals, roads, airports and rail.

The Chinese have different cultures and views, and the joint study will help overcome this. DG MOVE is finalising discussions with their Chinese colleagues and has placed terms of reference on their website. The joint study will start in early 2020 and publish results within a year. DG MOVE wants to help finance the most sustainable projects it identifies.

An audience member cited a need for a memorandum of understanding with China so it doesn’t simply take over in some EU countries. Ms Bakran Marcich said the EU Commission wants to make sure that the connectivity platform is supported by all members states. But each country must consider whether they are stronger vis-à-vis China alone or together with the EU.

Interoperability on the Silk Road

Conference speakers addressed Silk Road restrictions and opportunities related to train and container lengths and to interoperable, gauge-variable wagons.

Train lengths

Mr Bertram of LTE said that a big problem is the difference in allowed train lengths and tonnage on the 1520-mm network and in Europe, whose infrastructure is more restrictive. Whereas the 1520-mm network can forward 1.5-kilometre trains, the Netherlands is working towards trains lengths of 740 metres, Germany to 736. In Poland, trains will stay shorter for a longer time. Chris Wensink of Panteia said the Netherlands, whose infrastructure has limited trains to 590 or 630 metres until now, are planning to run ten 740-metre trains a week in early 2020.

GVT’s Roland Verbraak said in the Silk Route routing via the Russia enclave of Kaliningrad, 1.5-km trains are loaded into ships for EU ports. [GR: The ships’ ports presumably serve as buffers between the 1520-mm and 1435-mm networks.]

China Shipping is riding an Azerbaijan Railways wagon in an eastbound container train on the Silk Road’s Middle Corridor in the north throat of Tbilisi central station in Georgia on 10 February 2019. Photos © Pierre-Noël Rietsch

Container and wagon lengths

NSWL’s Oscar Vermeij said that a 45-foot container has space for 33 euro-pallets and can thus carry 20% more cargo than a 40-foot container. A length of 45 feet is also typical for European truck trailers.

GVT’s Roland Verbraak said that China has no 45-foot wagons yet, so 45-foot containers must travel on 80-foot wagons. An audience member said that 60-foot wagons are available in China. Nunner’s Tufan Khalaji said that some Chinese wagons built for 40-foot containers can fold down plates to carry 45-footers. But a $1600 surcharge for 45-foot containers applies in China currently. Mr Reeser of Essers/NSWL said that the 45-foot length will be the solution on the Silk Road, not 20 or 40.

Yingnan Yao of DB Cargo Logistics said she has been working since 2017 on the transport of finished automobiles from China to Ghent, Belgium, in trains of forty-one 40-foot containers, each of which can carry three autos tilted up on racks. This makes 123 autos per train. In contrast, the roll-on, roll-off (RoRo) double-decker wagons that move autos within Europe can fit 198 to 220 autos in a train of the same length. With the phaseout of Chinese subsidies for container transport, gauge-variable RoRo wagons for autos could be a cost-justified solution. [GR: But see my note on Silk Road wagon interoperability below.] Like today’s rack containers, Ms Yao said, RoRo automobile wagons would return empty, LTE’s Markus Bertram said that on certain origin-destination pairs, RoRo auto wagons could run full both ways.

An audience member said that another solution might be 45-foot rack containers that fit four automobiles (such as Volvo S90s) and still enjoy Chinese subsidies. The EU standard is now 45-foot containers, he said.

Interoperable railway wagons on the Silk Road

One way to reduce delays at Silk Road gauge-break points would be gauge-variable railway wagons. To run between Europe and China, such a wagon’s brake system, couplers and other characteristics would have to be interoperable on the EU, 1520-mm and Chinese networks. This is easier said than done, but at some point volume growth may justify it.

Some emerging Silk Road hubs and terminals

The conference also spotlighted some emerging Silk Road hubs and terminals.

Antwerp

Roland Verbraak of GVT said that a new destination of Silk Road trains will be Antwerp, where containers will transfer for trains to France.

Baku, Azerbaijan

Tural Aliyev said that the Port of Baku lies at the crossroads of north-south and east-west routes. A free trade zone under development at the port should become a major consolidation and distribution centre in central Eurasia. [See the section on the Middle Corridor.]

Bettembourg, Luxembourg

Imad Jenayeh of CFL Multimodal described a new rail service between Chengdu and Luxembourg. Given the Bettembourg terminal’s multimodal network in the region, he said, it has the potential to become the next European hub on the Silk Road.

Kaliningrad, Russia

BTE’s Roland Hawranek said that the port of Kaliningrad in the Russian enclave of the same name has relieved Małaszewicze and that transit times have dropped. [See the section on new routes.]

Kouvola, Finland

Simo Päivinen of Kouvola Innovation said that the city of Kouvola in southeastern Finland is the country’s most important dry port. It handles about 2 million tonnes of freight a year. Since November 2017, a container train service has been running between Xi’an in China and Kouvola, which as Railgate Finland is a hub for EU-China traffic.

Norvik, Norway

Micael Blomster described the planned rail movement of salmon from the port of Norvik through Russia to China. [See the section Salmon to cross Russia.]

Rzepin, Poland

Roland Verbraak said GVT is developing a service between the Netherlands and Rzepin, Poland, which is an electronics distribution centre for final destinations in Germany.

Zeebrugge, Belgium

Pepijn de Vreese of the Port of Zeebrugge and Jeroen Bozuwa of Ecorys said that the port is pursuing a role as a European gateway on the Silk Road. Ecorys provides the port with intermodal data and insights to support this.

The Silk Road and its Dutch hub(s)

The conference addressed the relationship and status of Dutch Silk Road hubs with their European neighbours and with China, and the special roles of Rotterdam and Venlo.

Dutch hubs and their neighbours

Cabooter’s Peter Pardoel said that for the Chinese, Tilburg, Luxembourg, Duisburg and Venlo all seem to be the same place. They ask how all these terminals can be competing. The Netherlands needs to present one face to customers.

Marcel Tijs of the Dutch Ministry of Infrastructure and Water Management said that although Dutch cities and their ports compete with one other, they are often in different market segments and thus have many common interests and opportunities for synergy. The same is true of Duisburg, Germany, especially since the pie is growing.

Roland Verbraak said that GVT has been running Europe-China trains for four years. GVT has 925 employees, its own intermodal terminals, barge terminals, warehousing and is now a railway undertaking able to run its own trains. They currently move 250,000 TEUs yearly by barge and 120,000 TEUs by rail. GVT has five cross-dock centres and now a big centre for e-commerce. In 2016, they started a train from Chengdu that now runs five times a week to Venlo and Tilburg. GVT is also involved with university and cultural exchanges with China. Mr Verbraak called Tilburg and Venlo the two logistics hot spots of Netherlands and said they are less congested than Duisburg.

A Chinese view of the Netherlands

Mr Ribao of the Chinese Embassy said that the relationship between China and the Netherlands, located at the two ends of the Silk Road, is characterised by mutual trust, innovation and “opening up”. The Netherlands is China’s second largest trade partner in the EU and “a major hub of BRI”. [GR: This may reflect China’s view of the Netherlands as one big hub instead of a cluster of such hubs.] Mr Ribao said that 90 cargo and passenger flights a week operate between Amsterdam and China. Some 137 countries and 30 associations have signed BRI memoranda of understanding, he said, but not the Netherlands. This has not prevented progress.

Port of Rotterdam

Hans Nagtegaal of the Port of Rotterdam asked whether Silk Road rail services are a threat or an opportunity for the port of Rotterdam, Europe’s largest. He said that the “maritime Silk Road” will cooperate and not just be an alternative to rail. Rotterdam’s volume grew from 6 million TEU in 2015 to an estimated 7.5 million TEU in 2019.

Rotterdam is the port outside Asia with the most traffic with China. Some 34% of Rotterdam’s traffic is with China. Rotterdam is a big transhipment hub with a competitive short-sea network and 250 weekly rail cargo services in Europe.

Mr Nagtegaal noted the development of the Mediterranean ports. The Chinese have a strong presence in the Greek port of Piraeus. Both China and European governments are investing Mediterranean ports, which are threats to Rotterdam. Are tendering processes the same in Italy and Greece as in northern Europe? But China is also investing in Rotterdam and Zeebrugge. Northern transhipment hubs will continue to compete with Mediterranean ones and may lose some volumes to them. This is okay if the playing field is level. Rotterdam has the advantage, however, of being in the Blue Banana, Europe’s richest zone.

Silk Road rail will provide its best service to the biggest hubs, Mr Nagtegall said. Rotterdam doesn’t see itself as a rail hub. Such hubs will develop further inland. Rotterdam is focusing on cooperating with Silk Road rail hubs such as Tilburg, Venlo and Duisburg instead of trying to be a terminal for China rail itself. But ocean and rail hubs need strategic links. The Dutch ports should unify their voices in China, maybe through an association. China don’t see or care about distinctions between the five major Dutch terminals.

Mr Nagtegaal emphasised the importance of digital infrastructure. We will never be the biggest port again, he said, but want to stay the smartest one. For example, customs procedures improvements for sea transport will also benefit rail to/from China.

Venlo

Mr van den Akker of Limburg province said that in spring 2020, Cabooter will open the EU’s third largest logistics terminal in Venlo. The Silk Road offers much potential for the Limburg logistics sector, he said, especially around Venlo. Limburg province has an official relationship with China’s Sichuan province, whose capital, Chengdu, is a Silk Road hub. Limburg wants to attain a place on the preferred partner list of Chinese Silk Road terminal coordinator Sinotrans.

Moving southeast, containers approach Blerick station and the Meuse river bridge leading to Venlo at sunset on 25 November 2019. Photo © George Raymond

Moving southeast, containers approach Blerick station and the Meuse river bridge leading to Venlo at sunset on 25 November 2019. Photo © George Raymond

Venlo mayor Antoin Scholten pointed out that Venlo is very close to Belgium and Germany. He said that the King of the Netherlands had visited Venlo’s logistics university that very morning. The port of Venlo is closely connected to the ports of Rotterdam and Antwerp. Within the last three years, new terminals have opened on the rail line between Eindhoven and Venlo and in Kaldenkirchen, Germany, about 6 km southeast of Venlo. The boom in e-commerce fulfilment is creating a need for smart warehouses, concentrated in Venlo, with links to the EU by three modes. Climate concerns are restraining air transport.

Mr Ribao of the Chinese Embassy praised Venlo’s unique location and said the city was investing in people and offered world-class logistics facilities.

Mr Pardoel of Cabooter said that Venlo and Limburg province have had a vision of efficient logistics. The Greenport Rail Terminal Venlo will open in 2020 and be able to handle 1.2 million TEUs yearly. Other relevant organisations in the area are Smart Logistics Center Venlo, Trade Port Noord and Crossroads Limburg, the former economic development board.

Mr Pardoel said Cabooter tested several new connections from Venlo to China in 2019. A rail freight service via the current main route [via Kazakhstan and Belarus] is about to become operative, while the route via Baku is also on the agenda. To develop China traffic, Cabooter works with Rail Cargo Austria and DB Schenker. He said that capacity and congestion are decisive. He has met with Erik Staake of Duisburg. The new Venlo terminal has no capacity issues. But Duisburg is also building new terminals.

Bert Roona of the Limburg promotion agency said they are helping develop Lean & Green Off-Road, a corridor connecting Rotterdam, the Venlo region and Chungking (China). Objectives are modal shift to rail, more logistics activities in Limburg, and more export of Dutch goods to China. The operator NSWL of Essers and KLG is also involved.

Information integration: the case of Caroz

The company Caroz Coordination Centre held a conference session at their Venlo office. Hosts were Rudy Claessens, who founded Caroz in 2000, and Sabine Klesman, who has been in business development for four years and leads strategic projects for tools and processes. The session provided insights into the integrated information systems or “control towers” that must support Silk Road shippers.

“Now everything has to be faster, smarter, greener and hopefully cheaper”, Mr Claessens said. In Caroz’s core function as a logistic control tower, the company coordinates and optimises the supply chain of its customers, including road, ocean, air and rail, and makes it transparent and visible.

Locations and size

Caroz operates from its headquarters in Venlo and its locations in China – Shanghai, Ningbo, Shenzhen, Hong Kong and Qingdao. The company has 30 employees in the Netherlands, 45 in China and turnover of €60 million. Mr Claessens said that the Asian market keeps on booming. Vietnam and India are growing in importance, he said, but you need your own infrastructure in that part of world.

History

After working for logistics companies, Mr Claessens founded Caroz in 2000. Until 2006, like the rest of the logistics world, they used telephone and fax – and it worked. Only freight forwarders understood the black box, so they could make money. Since 2006, the industry trend has been to transparency. Internet has had a huge effect. The role of traditional middlemen is disappearing. [GR: This is analogous to the decline of travel agents.] But big logistics players who offer their own dashboards to customers have not been able to fully push out freight forwarders.

In 2007-2008, Mr Claessens changed his model. He created a new IT platform and hired new people. In 2010 Caroz rebranded, launched its control tower based on their own software, and opened their first Asian office in Hong Kong. Caroz was the first company in the Netherlands to offer a control tower for logistics.

At the start, Mr Claessens said, customers were encouraging but hesitated to supply transport details to Caroz, which needed three to four years to prove that it was a value creator.

Working with new customers

Caroz has a growing base of customers with international supply chains. Mr Claessens said that when starting work with a new customer, Caroz first analyses the customer’s current situation. What warehouses and business units do they have – and what service providers? Are they efficient? Usually, the customer has no standard process or central information hub. This hinders growth and efficiency gains. Caroz begins with a pilot phase, with one or two modes, then builds out a relationship with the customer. Caroz gives the customer a better grip on the process side of the supply chain, Mr Claessens said. Caroz also helps the customer design how the future will look after they implement the controls Caroz recommends.

Before Caroz’s intervention, a customer typically has N to N information channels and information dispersed among different workers, providers and systems. Figuring things out can take months. After the transformation, all information and performance measures are centralised at Caroz.

Customers often procure transport themselves and get good line-haul rates. But demurrage and detention can make for hundreds of thousands of euros of hidden costs. Companies dealing with the freight forwarder’s traditional black box have little information on hinterland transport costs. Caroz opens the box and lets customers go beyond total transport costs and drill down into details.

The information Caroz organises also helps break down barriers between organisational silos within a customer. For example, a company’s product sales silo may promise delivery next week and simply pass an order to the logistics silo without knowing transport cost and lead time.

Choice of providers and solutions

Focussing on the transport side of the customer’s supply chain, Mr Claessens said, Caroz manages all modes. They act as a facilitator to find the best logistics providers. Caroz offers solutions, but also helps the customer find their own. Caroz can help a customer find a new provider if they are dissatisfied, but otherwise don’t look for problems with current carriers.

Caroz assembles and manages access to full information on rates provided by operators, Ms Klesman said. Caroz can also point out opportunities to consolidate LCL shipments and cases where the Caroz customer can profitably change the terms of carriage that govern how seller and buyer divide transport costs. Among their customers are pharmaceutical companies for whom Caroz can go into the market to find reefer operators, Mr Claessens said.

Management of operations

Ms Klesman said that Caroz usually receives an order from the customer’s input system. Caroz then takes care of the rest, integrating multiple systems and interfacing with the transport and customs departments of the customer, who may give their own customers access to the Caroz system. Efficient order management requires getting a grip on your process. For example, the order may specify a cargo – and paperwork – ready date, but Caroz checks a week in advance that this will be respected.

Looking northwest on 8 July 2019 from the station building at Małaszewicze Południowe, whose nearly 6 km of tracks are being rebuilt. Photo © Trakcja Group

Sophisticated IT and transparency is important, Mr Claessens said, but you still have manage the transport. He said that just selling IT is no good without providing someone to call who knows and understands you and the processes. Caroz sends the customer messages allowing management by exception. Caroz experts on all modes are in one room. For customs, Caroz has its own people and a “strategic agent” for complex cases.

Caroz does not let customers manage their own operations using the Caroz software, Mr Claessens said, but this could change. Caroz is not involved in parcels transport, as the market is controlled by big players, but is considering selling its software to customers in the parcels segment.

Performance evaluation

Besides managing operations for a client, Ms Klesman said, Caroz also provides information for performance evaluation and decision-making. A customer gets key performance indicators (KPIs) concerning finance, volume and performance, and can drill down to port, customer, pickup and delivery address, and transport provider. Caroz measures port-to-port and door-to-door transit time and reliability and provides details on exceptions.

Planning and objectives

Caroz helps customer prepare their detailed transport budget for next year and a road map for continuous improvement. The company wants to introduce artificial intelligence and predictive analysis.

Smaller and thus more agile

An attendee asked about the difference between Caroz and larger actors such as DB Schenker, Kuhn & Nagel and C.H. Robinson, which offer the same services. Mr Claessens said that Caroz is more agile because the company is smaller, and its customers tend to be smaller as well.

Caroz and Nunner

Mr Claessens said that Caroz is a niche player, which carries both advantages and risks. Big companies can be nervous about dealing with niche players. This is one reason Caroz joined the Nunner group in 2019.

Mr Claessens called Caroz fully independent. In its recommendations to customers, it does not favour Nunner. This preserves the credibility of Caroz as a neutral advisor. Big companies have they own control towers, so Caroz seeks mid-sized customers. Such customers are more comfortable with mid-sized Caroz+Nunner than they were with small Caroz. The larger Nunner group provides backup that lets Caroz react faster.

For Silk Road services, Mr Claessen said that Nunner’s rail solution “marries” with the infrastructure of Caroz in China. Erik Groot Wassink is Nunner’s rail specialist, Mr Claessen said, so he had no specific comments on rail. He had just been in Shanghai with Mr Wassink.

George Raymond can be reached at graymond@railweb.ch.

© Copyright 2020 George Raymond. All rights reserved.

Back to Railweb Reports